Connect with Customers Using Built-in Tools

Businesses are starting to cautiously re-open in the U.S. (at least partially), but we’re still a long way from “normal.” Because of COVID-19, some companies have done very well. Most, though, have had to make changes to comply with health guidelines and keep their customers and employees as safe as possible. And many consumers and businesses are less willing to spend money until they know more about the country’s path to recovery.

If your business has had to shut down temporarily, or at least scale back operations, we hope you’ve found ways to stay in touch with your customers. Even if you’re struggling, it’s important to communicate with the people who have helped you build your company.

QuickBooks can support you in this effort. Its integration with Microsoft Word makes it possible to create and dispatch letters or emails to customers that can fit a variety of common situations. There are dozens of pre-written templates that you can personalize and send to one or 10 or hundreds of the consumers and companies with whom you’ve built a relationship.

Here’s how it works:

Finding Your Message

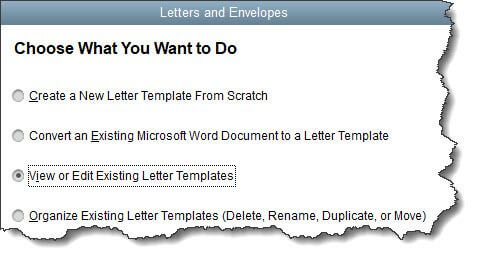

To get started, open the Customers menu and select Customer Center. To explore what’s available, click the down arrow next to Word in the toolbar, then select Customize Letter Templates. This window will open:

Figure 1: Before you start preparing customer letters, you should see what’s available.

Click the button in front of View or Edit Existing Letter Templates, and then click Next. You’ll see the available letter templates, divided into types. Spend some time clicking on each type to see what your options are.

Let’s say you want to send a letter to customers who haven’t been active for a while. Click the button in front of Customer and scroll down to Inactive customer. Select it and click Next. You’ll notice that Microsoft Word has opened and is displaying your letter template, which is now saved to your QuickBooks folder. If it’s in your taskbar tray, click to open it. Read through it and make any changes you want, then save to the current folder and close it. Click Use Template.

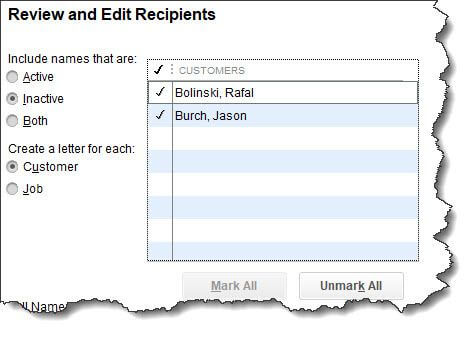

In the window that opens, you’ll select the recipients of your letter. Under Include names that are, you’ll click the button in front of Inactive. You want to direct your correspondence to customers, not jobs, so click the button in front of Customer. Look at the list that QuickBooks has displayed and make sure all of the entries have a checkmark in front of them. If you want to remove any of them, click the checkmark to turn it off. Click Next.

Figure 2: You can select the customers who are to receive your correspondence on this screen.

Editing Your Letter

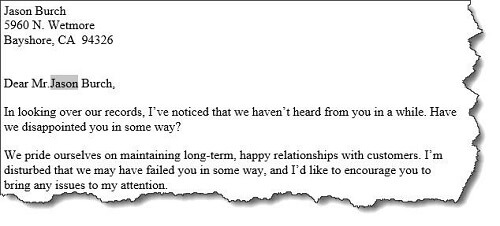

In the window that just opened, Inactive customer should be highlighted. Click Next. Enter the Name and Title that should appear in your letter’s signature. When you click Next again, a single Microsoft Word document will open containing all of your letters in one continuous document (each letter will start on a new page). You’ll be able to edit these letters without affecting the original template.

If you want to print envelopes, you’ll click Next. If you want to continue to edit and send your letters, click Cancel. Your personalized letters should be in your Windows taskbar tray. Open the document and scan through it to see if you want to change anything.

Figure 3: You can edit your customer letters individually.

In the example above, you might want to, for example, delete the customer’s first name so it just reads Dear Mr. Burch. Or, you might want to change the words “Have we disturbed” to something like “worried” in the second paragraph.

If you want to save these letters as edited, you can go ahead and do so. Otherwise, just print them as you would any Word document. Of course, you could copy and paste them into your email system and send them that way. But sending a signed, printed letter during these times provides a more personal touch.

You may have already developed the habit of communicating with your customers outside of exchanging sales forms and payments. If not, consider finding ways to interact occasionally with those individuals and companies that keep your business going. This is especially important right now, as we all wait to see how the recovery will continue to progress. If you need any assistance during this uncertain period, please don’t hesitate to call.