Creating Price Levels in QuickBooks

You already know that when you create a product or service record in QuickBooks, you must assign a sale price to it. But did you know that QuickBooks gives you a great deal of flexibility when to comes to pricing items you sell? The software allows you to create one or more additional Price Levels that you can access in invoices, estimates, sales receipts, credit memos, and sales orders.

There are three ways you can use these. Once you’ve created them, they’ll be available in a drop-down list in the Rate field. This means you can assign them manually to individual transactions. The second option is to assign them globally to specific customers or jobs. Once you’ve done so, that price will apply every time you create a transaction for one of them. Finally, you can create price levels for selected items.

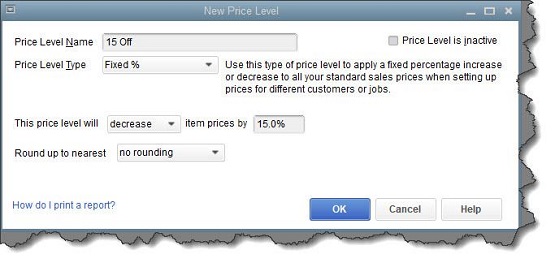

Here’s how it works. Let’s say you want to be able to create a price level that’s 15 percent below the actual price that you can use in individual transactions. You open the Lists menu and select Price Level List. Click the arrow in the lower left corner next to Price Level and select New. A window like this will open:

Figure 1: You can create price levels in QuickBooks and assign them to individual sales transactions.

Fill in the field next to Price Level Name, and then click the arrow next to Price Level Type. Select Fixed %. Select decrease from the drop-down list on the next line and enter your percentage number. Round up to the nearest is an optional field, Click OK when you’re done. The next time you create a sales transaction, your new price level will be available as an option when you open the drop-down list in the Rate column.

When you need to edit or delete a price level, go to Lists | Price Level List again and click the arrow next to Price Level in the lower left corner. You have several options here. You can, for example, make a price level inactive so it doesn’t appear on the list. The field next to Price Level is labeled Reports. Click on the arrow to see what’s available there.

Customers and Jobs

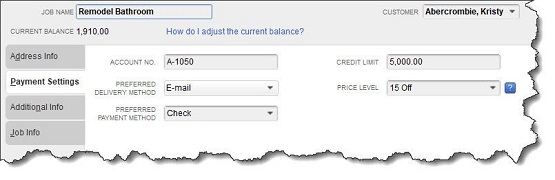

You can also apply a price level you’ve created to a specific customer or job, perhaps to reward a customer for frequent purchases. When you do so, that rate will appear every time you enter a sales transaction for the customer or job you selected.

Open the Customers menu and select Customer Center. Double click on a customer or job’s name to open the record. Click on the Payment Settings tab. Click the arrow in the field next to Price Level and select the right one, then click OK.

Figure 2: You can assign a Price Level to specific customers or jobs.

Per Item Price Levels

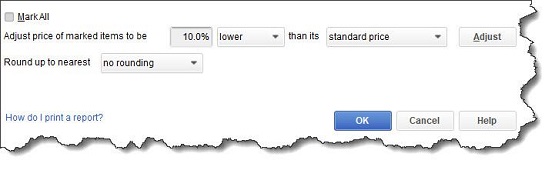

QuickBooks also allows you to set custom prices for specific items that are associated with preferred customers or jobs (this option is only available if you’re using QuickBooks Premier or Enterprise). Let’s say you want to give a 10 percent discount to specific customers who purchase your website development services. Go to Lists | Price Level List and click the arrow next to Price Level in the lower left corner again, then select New (you can also get to the New command by right-clicking anywhere in the window).

Give your price level a name (like Web Development 10 Off) , then select Per Item from the Price Level Type drop-down list. Click in front of the Item you want to include. The fields in the next line should read as pictured in the image below: 10% | lower | standard price. Click Adjust. You’ll see your reduced prices in the Custom Price column in the table above.

Figure 3: You can establish a Price Level for specific items in QuickBooks.

Again, the rounding field is optional. When you’re finished here, click OK. The next time you create a sales transaction for a customer who is eligible for the lower price, you’ll select Web Development 10 Off from the drop-down list in the Rate column.

Feel like you’re outgrowing your current version of QuickBooks, or is it several years old? Don’t hesitate to call if you need additional support or are ready to upgrade your current QuickBooks software to help you run your business more efficiently and effectively as it grows.