7 Ways to Use QuickBooks to Manage Collections

In these trying economic times it’s more important than ever to keep a close rein on your accounts receivable. Seemingly no one is immune to sudden changes in financial circumstances, so be sure to monitor your outstanding invoices closely. There’s an inverse relationship between the age of an invoice and your ability to collect on it, but fortunately QuickBooks can help you manage your credit risk:

1. Set Reminders

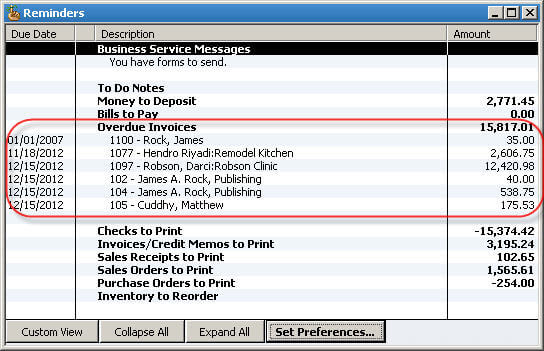

As shown in Figure 1, QuickBooks can display a reminder window when you open your QuickBooks company:

Choose Company, Reminders, and then click the Set Preferences button.

Choose the My Preferences tab, and then click the Show Reminders List When Opening a Company File on the My Preferences tab.

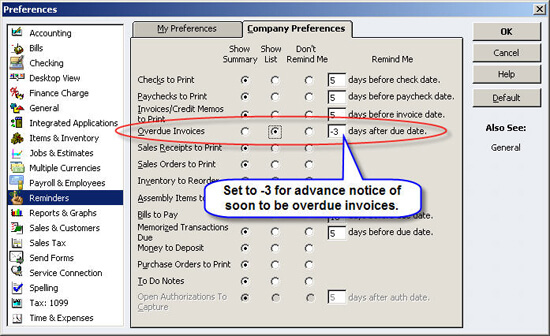

Click the Company Preferences tab, and choose Show List for Overdue Invoices. As shown in Figure 2, you can enter a negative number to be notified of overdue invoices before they reach their due date. Click OK to save your changes.

Figure 1: QuickBooks can show you a list of overdue invoices whenever you open your company.

Figure 2: Enter -3 in the Days after Due Date field to be notified when invoices are within 3 days of their due date or later.

2. Monitor Customer Balances

In addition to tracking overdue invoices, you should also stay abreast of how much credit you’ve extended to each of your customers. One way to do this is to use the Customer Center whenever you create new invoices:

Choose Customers, and then Customer Center (you can also click the Customer Center toolbar icon or press Ctrl-J).

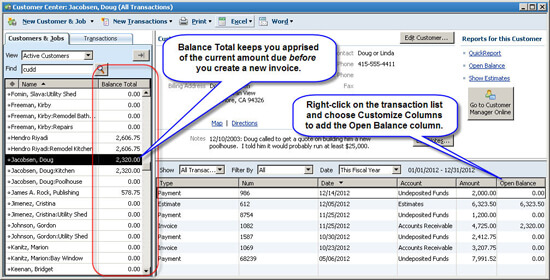

As shown in Figure 3, the customer center lists the Balance total for each customer. You can use this information to determine whether you want to sell additional products or services. You can quickly create an invoice from the Customer Center: select a customer name, and then press Ctrl-I (as in I for invoice).

As also shown in Figure 3, you can add an Open Balance column to the transaction list. To do so, right-click on the transaction list, and then choose Customize Columns. Choose Open Balance from the Available Columns list, and then click the Add button.

Figure 3: The Customer Center makes it easy to monitor open invoices.

Expert trick: To sort customer open balances in descending order, click twice on the Balance Total column.

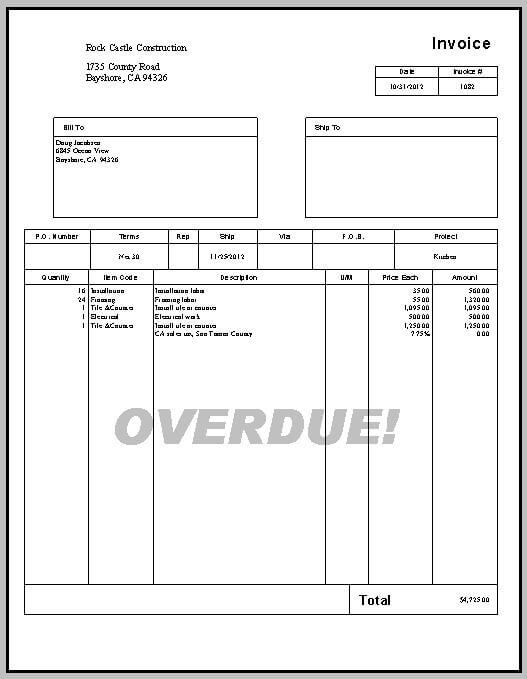

3. Create an Overdue Watermark

An attention getting messages, such as “OVERDUE!” or “PLEASE PAY!” can add impact to follow-up copies of invoices that you send out. It’s easy to add a watermark to your invoices:

Choose Customers, and then Create Invoices to display the Create Invoices window.

Click the Customize button on the toobar, and then click the Manage Templates button.

Select an existing invoice, such as Intuit Product Invoice, and then click the Copy button.

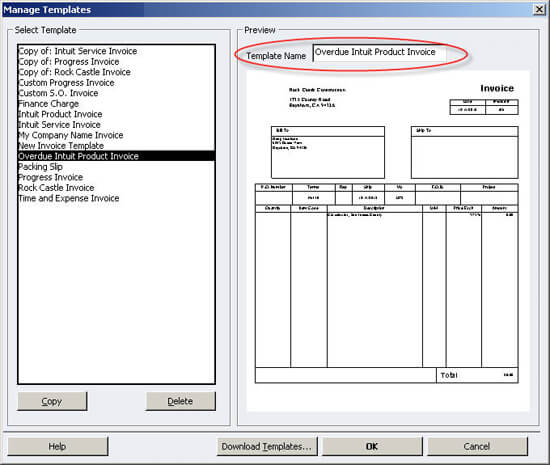

Use the Template name field shown in Figure 4 to assign a name like Overdue Intuit Product Invoice, instead of Copy of: Intuit Product Invoice.

Click OK to close the Manage Templates window, and then click the Layout Designer button in the Basic Customization window.

Click the Add button on the toolbar, and then choose Text Box.

Enter the message you want to add in the Text field, such as OVERDUE!

Click the Font button, and then make these changes:

- Set the Font Name to Arial Black

- Set the Font Style to Bold

- Set the Font Size to 60

- Change the Font Color to Silver

Once you’ve set the font settings, click OK to close the Font dialog box, and then click the Border tab. Unclick Top, Left, Right, and Bottom, and then click OK.

Resize and reposition the text box on your invoice, such as in the center of the body section, as shown in Figure 5.

Right-click on the text box and choose Order, and then Send Backward.

Figure 4: Assign a meaningful name to your new template.

Figure 5: You can add an OVERDUE! Watermark to a customized QuickBooks invoice template.

Going forward, you can choose this template from the list anytime you wish to follow-up on an overdue invoice.

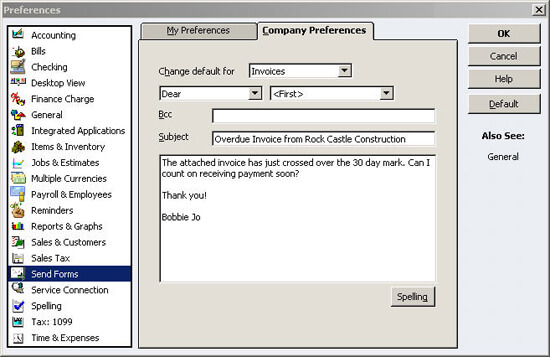

4. Send E-mail Follow-ups

A friendly note can sometimes shake a payment loose on an overdue invoice. For instance, you can choose Reports, Customers & Receivables, and then A/R Aging Detail. Double-click on the invoice in question to display it onscreen, and then click the Send button on the toolbar, which looks like an envelope with a green arrow.

As shown in Figure 6, you can change customize the body of the e-mail to your liking. If you typically mail print copies of your original invoices, then consider changing the default text of the e-mail to make your collections easier.

To do so, click the Edit Default Text button and then make any changes that you like. Do note that these changes won’t appear in the Send Invoice window until you close it and click the Send button again. Click the Send Now button to e-mail the invoice copy to your customer.

Figure 6: Customize the default e-mail text to simplify invoice follow-ups.

5. Use Statements

QuickBooks makes it easy to send statements to one or more customers. Choose Customers, and then Create Statements. Set the desired options, including which customer or customers to contact, and then choose Print or Email to generate the statements.

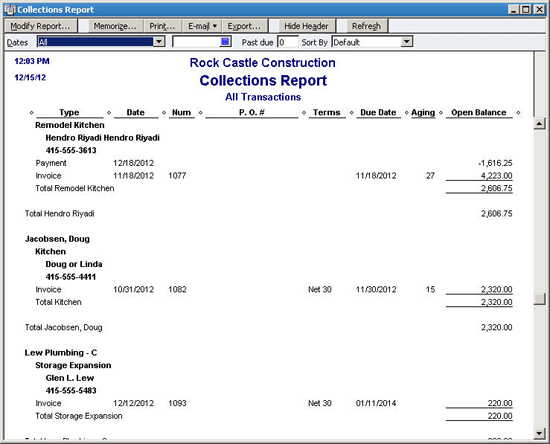

6. Tweak the Collections Report

When calling on an overdue invoice, it’s helpful to make sure that your customer is aware of all pending invoices. You can easily tweak this report so that it lists all open invoices:

Choose Reports, Customers & Receivables, and then Collections Report.

Click the Modify Report button, and then click on the Filters tab.

As shown in Figure 7, click on the Date filter, and then choose Remove Selected Filter. Do the same for the Aging and Due Date filters, and then click OK.

As shown in Figure 8, the Collections Report now displays all open invoices. You can click the Memorize button to save this report for future use.

Figure 7: Modify the Collections Report filters to add helpful information to this report.

Figure 8: The resulting report shows all open invoices, as well as contact names and telephone numbers.

7. Accept Credit Cards

Many business owners avoid accepting credit cards due to the fees involved, which can top 3%. However, 97% of an overdue invoice is far better than 0%, or having to wait even longer to collect.

You can learn about QuickBooks Merchant Services by choosing Add Credit Card Processing on the Customers menu in QuickBooks. Or, consider a payment service like PayPal (www.paypal.com), which offers a free Request Money with QuickBooks wizard. Look under the Merchant Services section of your PayPal business account.