Do You Need a More Robust Version of QuickBooks?

If QuickBooks were just one product, its appeal would be more limited than it is. Because there’s an entire family of Windows desktop software applications (as well as five online versions and a Mac edition), the QuickBooks family has found a home in millions of small businesses, and it remains the market leader.

Though QuickBooks versions themselves are not scalable (able to expand as your business grows), you can move up to a more sophisticated edition when you outgrow your current version.

But how do you know whether it’s time to upgrade or whether you’re just not stretching your current version to its fullest capabilities? We can help you determine that, and we’ll help you move into a more appropriate edition when/if that occurs.

Desktop Differences

There are three Windows-based versions of QuickBooks: Pro, Premier and Enterprise Solutions. They all let you:

- Import and export data

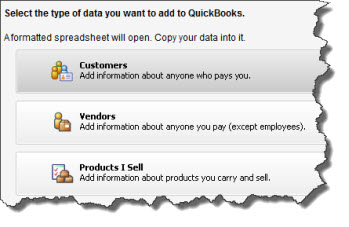

Figure 1: All desktop versions of QuickBooks let you import and export data.

Figure 1: All desktop versions of QuickBooks let you import and export data. - Track income and expenses

- Build and maintain records for customers, vendors, employees and items

- Create and send transaction forms like invoices, estimates and purchase orders

- Download bank and credit card transactions, and pay bills online

- Customize and run dozens of reports

- Keep track of your inventory of items, and

- Add a payroll-processing service.

All three versions share a similar user interface and navigational scheme, so when you move up to the next level, you only need to learn the new features. The 2013 offerings make it even easier to learn and use QuickBooks, since Intuit completely revamped the look and feel for those most current editions.

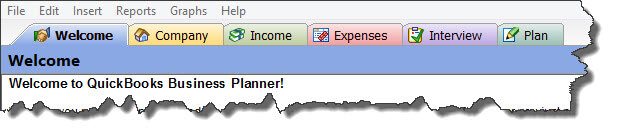

QuickBooks Pro is the base desktop product, offering everything in the above list and more. But would you rather have access to 150+ reports instead of 100, including some that are industry-specific? QuickBooks Premier can provide that, in addition to charts of accounts, sample files and menus tailored to your company’s industry. It also offers a business plan builder and the ability to forecast sales and expenses.

Figure 2: QuickBooks Premier helps you create a business plan.

The biggest jump in functionality, though, occurs when you move up to QuickBooks Enterprise Solutions. You may want to consider this upgrade when you find that, for example:

- Your system keeps slowing down and experiencing errors because your customer, vendor, item and employee databases have grown too large

- You need to have more than five people accessing QuickBooks simultaneously

- You’ve launched a second company, and/or

- Your item catalog has grown to the point where you’re having trouble managing your multi-location inventory.

Robust Accounting

QuickBooks Enterprise Solutions is well-suited to complex small businesses, and sometimes even larger companies, depending on their structure and needs. It solves the data management problems that Pro and Premier users can experience, thanks to its 100,000+ record and account capacity.

Up to 30 individuals can use the software at the same time, and they have more flexibility than is offered in Pro and Premier. Multiple users can be on the system and still complete tasks like adjusting inventory and changing sales tax rates.

You can manage more than one business using QuickBooks Enterprise Solutions, even working in two company files at the same time and combining reports. Reporting capabilities themselves are much more sophisticated: The Intuit Statement Writer helps you create professional financial statements, and you have much more control over customization of your output.

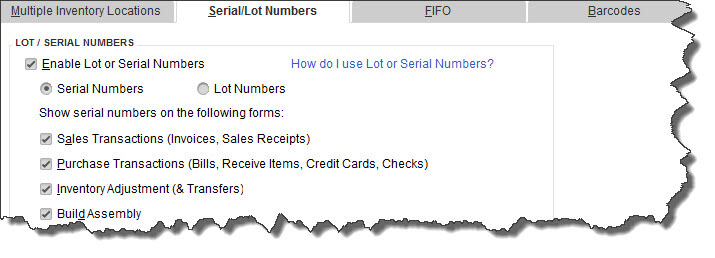

Figure 3: QuickBooks Enterprise Solutions offers more sophisticated inventory management tools than Pro or Premier.

Inventory management goes many steps further in this sophisticated software. It supports management of multiple warehouse and trucks, and allows transfers among them. Finding specific items is much easier because you can track down to the bin level. FIFO costing is offered as an alternative to average costing, and you can scan items and serial numbers directly into QuickBooks Enterprise Solutions, which tracks both serial and lot numbers.

More Power, More Support

There are many smaller features that make this application far more powerful than QuickBooks Pro and Premier ‘ and also a little more difficult to master. When you think the time is right, we can help you move your current data file into QuickBooks Enterprise Solutions and provide training.

It’s important that you have the right fit when it comes to your accounting software. So consider your current setup carefully before you decide to move up.