Establishing Preferences in QuickBooks

QuickBooks was designed to serve the needs of millions of small businesses. To do that, it had to include the tools and processes suitable for a wide variety of companies. But Intuit recognized that every organization is unique, so your copy of QuickBooks can be customized in ways that make it work best for you.

You could just dive in and start adding records and transactions but doing some setup first is highly recommended. If you don’t, you may run into some issues later, such as finding that some features you need haven’t been turned on, for example, or that QuickBooks is simply not doing some things the way you do. The good news is that you can change many of these.

Getting There

QuickBooks refers to these options as Preferences. You will find them by opening the Edit menu and selecting Preferences.

Figure 1: To start customizing QuickBooks so it works best for you, open the Edit menu and choose Preferences.

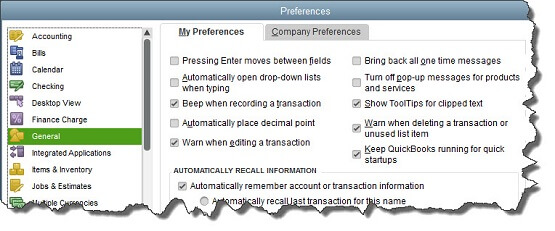

As you can see, the left vertical pane contains a list of Preference types. Click on any of these to change the option screens to the right. Always click the tabs labeled My Preferences and Company Preferences to make sure you see everything that is displayed for each type (sometimes one will have no choices).

Setting up Reminders

Let’s look more closely at one set of Preferences: Reminders. It’s very important that you visit these screens when you begin using QuickBooks. Depending on how big your company is and how complex your accounting processes are, there may be things you need to do every day, like pay bills and follow up on overdue invoices. It would be nearly impossible for you to do everything on time if you did not ask QuickBooks to keep track of critical dates and remind you of them.

Click Reminders in the left vertical tab. You will see one option under My Preferences. Do you want QuickBooks to show Reminders List when opening a Company file? If so–and this is a good idea–click the box in front of that line if there is not a check mark there already, and then click Company Preferences.

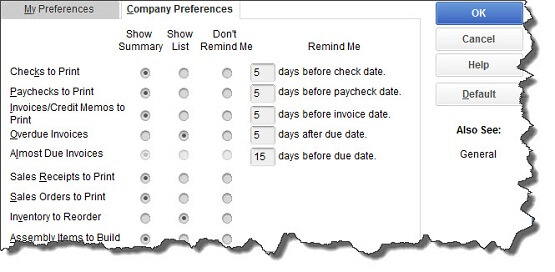

Here is where you will tell QuickBooks whether you want to see summaries or lists for each reminder, or neither. You can also specify how much advance notice you want for specific tasks by entering a number of days. QuickBooks comes with default settings, but you can easily change these.

Figure 2: QuickBooks comes with default settings for Reminders, but you can enter your own Preferences here.

As you can see, it is easy to specify your Company Preferences. Click the appropriate button under Show Summary, Show List, or Don’t Remind Me. If you’ve requested a reminder, delete any number that appears in the box in front of days before or days after and then enter your own.

Critical Areas

Make sure that you look through all of QuickBooks’ Preferences and change any that don’t fit your company. Some simply have to do with the way QuickBooks displays information and how it functions, but others have direct impact on your accounting work. As always, call the office if you have any questions.

You will probably want to visit many of the options under Preferences because each may have numerous options. Here are several examples of what you might want to consider:

- Accounting. Do you want to use account numbers and classes?

- Checking. Which accounts should QuickBooks automatically use for tasks like Open the Pay Bills, Open the Make Deposits, and Open the Create Paychecks?

- Finance Charge. Will you be assessing finance charges on late payments from customers? What is the interest rate, minimum finance charge, and grace period?

- Items & Inventory. Do you want inventory and purchase orders to be active?

- Multiple Currencies. Does your company do business using other currencies?

- Payments. Can customers pay you online? What methods can they use?

- Payroll & Employees. Will you be processing payroll using QuickBooks?

- Sales & Customers. Do you want to use sales orders? How should QuickBooks handle invoices when there are time and costs that need to be added?

You can see why it is important to study QuickBooks’ Preferences early on. It will help you avoid unnecessary roadblocks and ensure that your company’s needs are reflected well in the software.