Getting QuickBooks Ready for Tax Preparation

Seems like you just finished doing your taxes, and here they come again. Whether you prepare them yourselves, hand them off to an accounting professional, or send data to a tax preparation product, QuickBooks can help you get ready.

Here’s how. This is not a comprehensive list of tasks you’ll need to undertake to prepare for taxes. Rather, it’s an overview of QuickBooks’ most tax-specific tools. QuickBooks supports many business tax forms, including the 1040, 1120, and 1065, and the steps outlined here apply to all small business tax filers using QuickBooks Pro, Premier, and Enterprise.

If you haven’t already (and you should have), order your W-2 and 1099 Kits

These forms must be filed at the beginning of each year; they report employee wages and salaries to Federal, state, and local agencies. Data is printed directly from QuickBooks onto the correct line in the forms. You can purchase these kits (shown in Figure 1) directly from Intuit, and you must have a Standard Payroll or Enhanced Payroll subscription in a supported version to process them.

Figure 1: Intuit sells kits that help you print QuickBooks tax data directly on the correct forms.

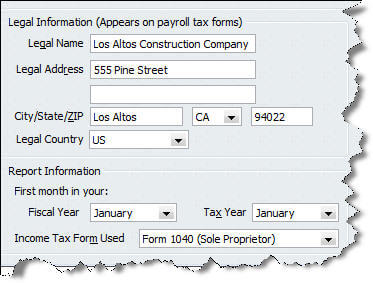

Check the Company Information window to make sure it reflects the right tax form

This is crucial no matter who is preparing your taxes. You should have been thinking ahead to tax time when you set up your company in QuickBooks, but you can take this step prior to starting your prep.

Make sure you’ve specified the appropriate tax form for use in QuickBooks. Go to Company|Company Information, as shown in Figure 2. At the bottom of the window, find the Income Tax Form Used line, and make sure it’s set to the correct form.

Figure 2: On the Company Information window, be sure that the Income Tax Form Used line is pointing at the correct form.

In this same window, check the fiscal year dates to make sure they’re correct, and that other tax-related fields are filled out accurately.

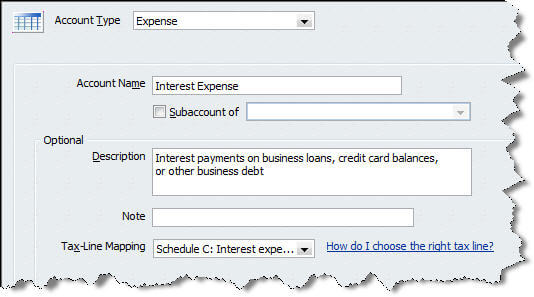

Make sure your tax-related accounts are assigned to the correct tax line on the form

If you used the EasyStep interview for setup, QuickBooks automatically assigned some accounts to the correct tax line. You can change these at any time, and add your own accounts. This Tax-Line Mapping will be important down the road if you export data to an Intuit tax product and/or run tax reports.

Warning: Altering the Chart of Accounts is a precise operation, and affects many parts of QuickBooks. You may want to consult with an accounting professional.

Click Lists|Chart of Accounts. Select an account, like Interest Expense, and right-click on it.

Click Edit Account, and the window shown in Figure 3 appears.

Figure 3: QuickBooks lets you do Tax-Line Mapping, which specifies the relationship between accounts and tax form lines.

If you want to change the tax line, click the arrow to the right of the current selection and choose the correct one from the drop-down list. To add an account, click Lists|Chart of Accounts. In the bottom left of the screen, click the arrow in the Account button. Click New, and follow the instructions in the wizard that opens.

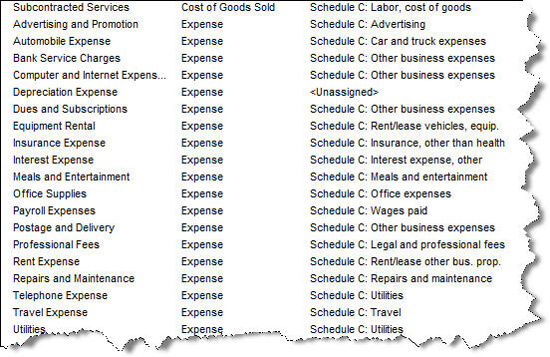

Run tax-related reports

QuickBooks provides three reports that you’ll need whether you or your accountant is preparing your taxes. To find them, click Reports|Accountant & Taxes.

The first report is the Income Tax Preparation Report. This lays out a list of your accounts and the tax line each is assigned to. If any that need to be assigned are unassigned, double-click on them to get to the Tax-Line Mapping window, as shown in Figure 4.

Figure 4: The Tax Preparation Report illustrates how your accounts have been assigned to tax form line items.

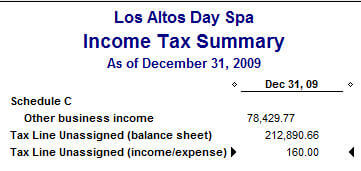

Two other reports are available: Income Tax Summary and Income Tax Detail, which are just what they sound like. They provide detailed and summarized lists of transactions and their totals. You can drill down on these to see the underlying transactions.

Warning: When you run Income Tax Summary, look for a line that says Tax Line Unassigned (income/expense). Double-click on any total there to see accounts that need to be assigned to a tax line, as shown here in Figure 5.

Figure 5: You can quickly check your accounts in the Income Tax Summary.

QuickBooks lets you modify these reports to include additional columns, and memorize them for easy access later. Click the Modify Report and Memorize buttons in the upper left corner to do so.

You can’t avoid taxes, but you can sure take a lot of the pain out of their preparation by using QuickBooks throughout the year to get ready. And you may get a smile out of your accountant when you hand over your carefully created records.