How To Easily Track Your Inventory

Do you know where your physical inventory items are? Whether you keep them in a closet, in an unused office, or a warehouse, you need to keep a close watch on how many products you have, how many have been ordered, and when it’s time to reorder. Fortunately, QuickBooks has tools that help you track all of those numbers. If you’re conscientious about making use of them, you should have a good sense of the state of your inventory, wherever you store it.

Note: These tools are not available in Simple Start or QuickBooks Online.

Inventory 101

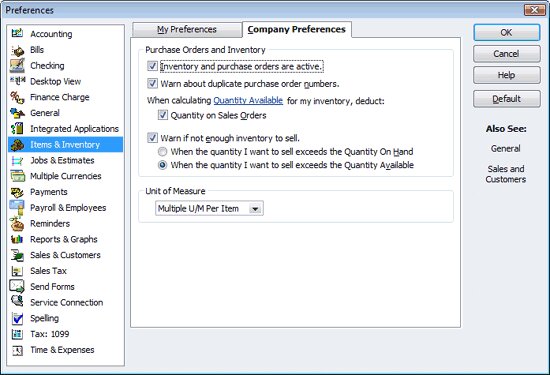

Let’s take a look at the life of an inventory item. First, you have to tell QuickBooks that you will be selling products. It asks for this information during the EasyStep interview, but if for some reason you didn’t set this up, you can still do it. Click Edit/Preferences, then Items & Inventory, and then Company Preferences. Make sure the first line is checked, as well as any others you want active, as seen in Figure 1.

Figure 1: You can have QuickBooks track your inventory by selecting this option in the Preferences window.

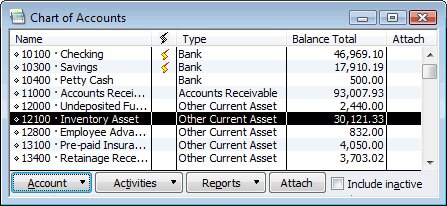

Next, check your Chart of Accounts to see if you need to add any accounts to meet your inventory needs. This is easy. Go to Lists/Chart of Accounts, or click the icon on the home page. The Chart of Accounts is simply a list of the accounts your company uses, and the balance for each. QuickBooks sets a chart up for you based on the type of company you have, but as your business grows, you may need to add more. Figure 2 shows an example of the Chart of Accounts window.

Figure 2: The Chart of Accounts window shows you the balance for each of your accounts.

To add a new account, click on the arrow next to Account and click New. Select the correct type of account, and answer the questions in the Add New Account window. If you have any questions here, consult QuickBooks’ help file.

See Your Inventory In High Definition

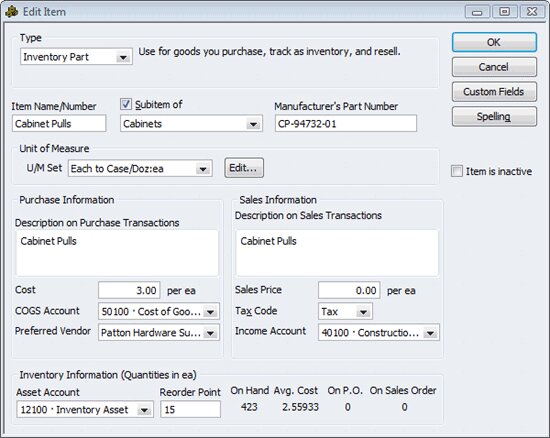

Next you’ll have to define your company’s products. Click Items & Services on the home page. The Item list opens. You can always come back here when you need to edit an item, but you may want to create one now. So click Item/New. You’ll see a screen similar to the one pictured in Figure 3, but its fields will be blank. Item records in QuickBooks contain a good amount of information about each item, which will be used in forms like invoices and documents like reports.

Figure 3: An item record allows you to define your company’s product.

Fill out the information in each item record for each item you sell. You won’t be able to alter the numbers in the lower right corner; these come from other parts of the program. As for the other values, the need to make changes depends on the field. When you defined the item, you entered an On Hand amount. This of course will change as you sell, so you can change the reorder point. Conversely, the average cost (value of your inventory) is calculated by the program; it’s the total cost of items in stock divided by the number of items in stock. On P.O. and On S.O. simply indicate how much of your inventory is promised on purchase orders and sales orders.

Get Better Organized

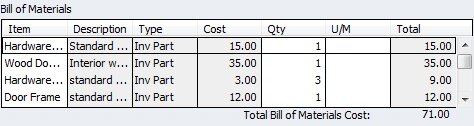

QuickBooks lets you create assemblies, groups of items that are sold together as a kit. If you want to create one, click Lists/Item List, then click the arrow next to Item and click New. Click the arrow under Type, and select Inventory Assembly. Fill in the blanks on the window as you would for a single item, and select the individual inventory items in the box at the bottom. This box is pictured in Figure 4.

Figure 4: An item assembly.

Once you’ve defined your items and assemblies, you can use them in two places primarily: transactions forms and records. Let’s say you’re creating an invoice. As you’re filling out the form, you’ll be able to click the arrow under ITEM and view a list of the items you’ve created. Click on one, and the details you’ve entered (like price) will appear. Click Reports/Inventory to customize and run the reports available.

Maintaining an adequate inventory-not keeping too much or too little on hand-is critical to your company’s financial balance. QuickBooks’ tracking tools can help you meet that ongoing goal.