Receiving Payments in QuickBooks

There are numerous ways to prioritize your workday. Do the most difficult things first. Get important phone calls out of the way. Respond to customer emails.

But it’s likely that one activity takes precedence when you see that it needs to be done: recording payments. While you’re probably very careful with this process, it’s critical that your actions here are accurate. If they’re not, you could either lose money that you’ve earned or anger customers by requesting payments they’ve already made.

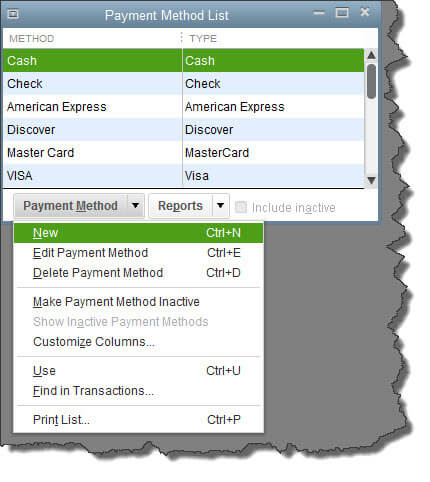

QuickBooks comes with some helpful pre-defined payment types; however, you also have the flexibility to edit that list and add new types. To see your list, open the Lists menu and select Customer & Vendor Profile Lists, then Payment Method List. This window opens:

Figure 1: QuickBooks lets you accept payments from customers in a variety of ways.

To make changes to this list, click the down arrow to the right of Payment Method. By selecting items from this menu, you can add, edit, and delete payment methods. You can also make one temporarily inactive if for some reason you’re not going to support that option right now but don’t want to delete it, either. Click in the box next to Include Inactive if you want it to remain on the list (an X will appear next to it). When you want to reinstate it, open the Payment Method menu again and select Make Payment Method Active.

To search for every transaction that used a specific payment method, highlight it in the list and select Find in Transactions. QuickBooks will open the Find window with that filter already applied.

When you’re done working with that window, click the x in the upper right to close it.

Applying the Funds

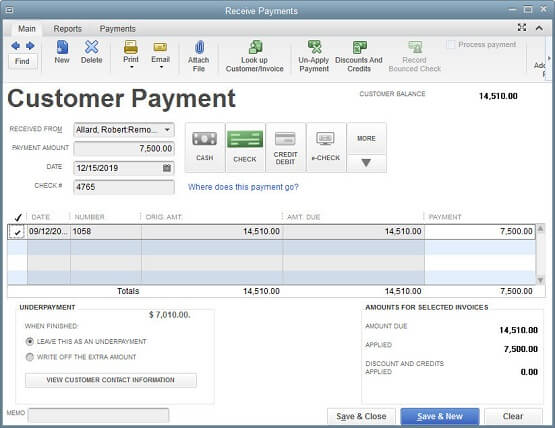

Ideally, you or someone on your staff will be working frequently with the Receive Payments screen frequently. To get there, open the Customers menu and select Receive Payments, or click Receive Payments on the home page. This is the screen you will work with if you’re recording a payment that is to be applied to an invoice that you sent.

Figure 2: The Receive Payments screen in QuickBooks

First, select a customer by clicking on the down arrow in the field to the right of RECEIVED FROM. If there are outstanding invoices, they will appear in the table below. Enter the PAYMENT AMOUNT in the field below, and change the date if necessary. Click on the icon representing the payment method. If you don’t see it there, click the down arrow below MORE and add it or select it. Your chosen icon will turn green. Then:

- For cash or e-checks: Just enter any REFERENCE # needed.

- For checks: Enter the CHECK #.

- For credit/debit cards: If you’ve saved the customer’s preferred payment method in his or her record, the number will fill in automatically. If not, or you need to change it, enter it manually. As you know, you need a merchant account in order to accept credit/debit cards and e-checks. If you haven’t set one up and want to, let us help.

If the payment amount equals the total of all outstanding invoices, there will be a check mark in the first column of every line in the table. If the payment is for any less than the CUSTOMER BALANCE in the upper right, QuickBooks automatically pays the oldest invoice(s) first. You’ll also see an UNDERPAYMENT box in the lower left corner. Click the button in front of your preference here (leave as underpayment or write off the extra).

When you’re done, click one of the Save buttons.

Other Types of Payments

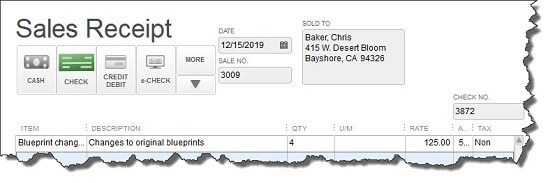

You’ll also use the Receive Payments window to record down payments and overpayments. And there are situations where you’ll have to complete other forms to document the incoming money. For example, if a customer makes a partial payment for products or services that haven’t yet been invoiced, you’d use a Payment Item. A customer who pays for a product at the time it is received would get a Sales Receipt.

Figure 3: Sales receipts go to customers who pay for products or services at the time they are received.

This may all sound a little confusing. But it won’t be if you gain a thorough understanding of the right way to record different types of payments. We can go over all of this with you to ensure that your incoming money is documented correctly, which will take less time than trying to retrace your steps when a mistake has occurred.