Spring-Clean Your QuickBooks Company File

Come spring time, most people are eager to throw open the doors and windows, and do some spring cleaning. It’s a good time to “spring clean” Quickbooks as well.

It’s not difficult to see when your home needs cleaning, but QuickBooks company file errors are harder to detect, including:

- Performance problems

- Inability to execute specific processes, like upgrading

- Occasional program crashes

- Missing data (accounts, names, etc.)

- Refusal to complete transactions, and

- Mistakes in reports.

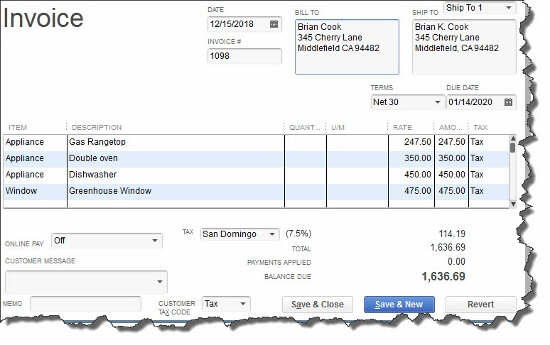

Figure 1: If some transactions won’t go through when you click one of the Save buttons – or worse, QuickBooks shuts down – you may have a corrupted company file.

Call for Help

The best thing you can do if you notice problems like this cropping up in QuickBooks–especially if you’re experiencing multiple ones–is to contact us. We understand the file structure of QuickBooks company data, and we have access to tools that you don’t. We can analyze your file and take steps to correct the problem(s).

One of the reasons QuickBooks files get corrupt is simply because they grow too big. That’ either a sign of your company’s success or of a lack of periodic maintenance that you can do yourself. QuickBooks contains some built-in tools that you can run occasionally to minimize your file size.

One thing you can do on your own is to rid QuickBooks of old, unneeded data. The software contains a Condense Data utility that can do this automatically. But just because QuickBooks offers a tool doesn’t mean that you should use it on your own.

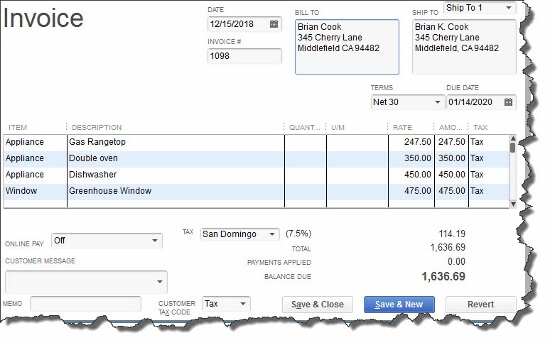

Figure 2: Yes, QuickBooks allows you to use this tool on your own. But if you really want to preserve the integrity of your data, let us help.

A Risky Utility

The program’s documentation for this utility contains a list of warnings and preparation steps a mile long.

We recommend that you don’t use this tool. Same goes for Verify Data and Rebuild DataUtilities menu. If you lose a significant amount of company data, you can also lose your company. It’s happened to numerous businesses.

Be Proactive

Instead, start practicing good preventive medicine to keep your QuickBooks company file healthy. Once a month or so, perhaps at the same time you reconcile your bank accounts, do a manual check of your major Lists.

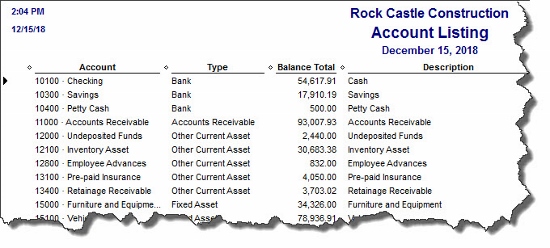

Run the Account Listing report (Lists | Chart of Accounts | Reports | Account Listing). Are all of your bank accounts still active? Do you see accounts that you no longer used or which duplicate each other? Don’t try to “fix” the Chart of Accounts on your own. Let us help.

Figure 3: You might run this report periodically to see if it can be abbreviated.

Be very careful here, but if there are Customers and Vendors that have been off your radar for a long time, consider removing them, but only once you’re sure that your interaction with them is history. Same goes for Items and Jobs. Go through the other lists in this menu with a critical but conservative eye. If there’s any doubt, leave them there.

A Few Alternatives

There are other options. Your copy of QuickBooks may be misbehaving because it’s unable to handle the depth and complexity of your company. It may be time to upgrade. If you’re using QuickBooks Pro, move up to Premier. And if Premier isn’t cutting it anymore, consider QuickBooks Enterprise Solutions.

There’s cost involved, of course, but you may already be losing money by losing time because of your version’s limitations. All editions of QuickBooks look and work similarly, so that your learning curve will be minimal.

Also, try to minimize the number of open windows that are active in QuickBooks. That will improve your performance. And what about your hardware? Is it getting a little long in the tooth? At least consider adding memory, but PCs are cheap these days. If you’re having problems with many of your applications, it may be time for an upgrade.

A Stitch in Time…

We’ve suggested many times here that you contact us for help with your spring cleanup. While that may seem self-serving, remember that it takes us a lot less time and money to take preventive steps with your QuickBooks company file than to troubleshoot a broken one.