Ten Overlooked QuickBooks Reports That You Should Use

Just about every QuickBooks user relies on the Report Center and Reports menu, but if you’re like most, you have a small handful of reports that you tend to rely on. In this article we’ll go off the beaten path and explore ten reports that many users overlook. Even if you are using some of these reports, we’re sure you’ll find a few more to add to your repertoire.

1. Profit & Loss Summary Prev Year Comparison: To access this report, choose Reports, Company and Financial, and then Profit & Loss Summary Prev Year Comparison. Most business owners rely on the Profit & Loss Summary report, but comparing your results to last year can provide quick insight into whether your revenue is growing or contracting-as well as how fast expenses are rising.

2. Balance Sheet Prev Year Comparison: You’ll find this report also within the Company and Financial section of the Reports menu. As with your income statement, it’s important to compare where certain balances stand now versus last year:

- Cash

- Accounts Receivable

- Inventory

- Accounts Payable

- Other Liabilities, such as lines of credit or short term loans

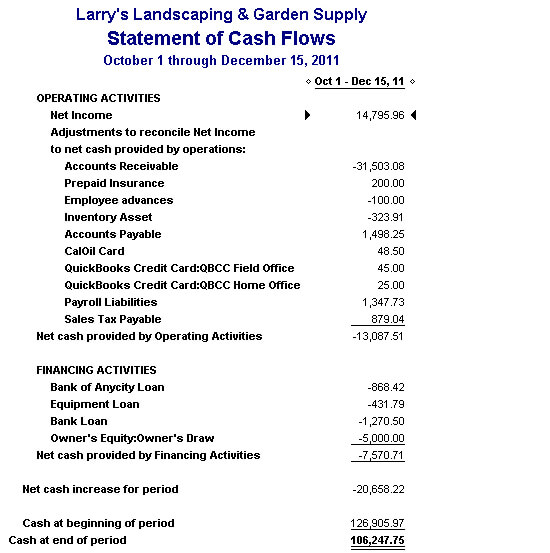

3. Statement of Cash Flows: As with the two preceding reports, you’ll find the Statement of Cash Flows in the Company & Financial section of the Reports menu. Profit & Loss reports enable you to see what you earned, while Balance Sheet reports help you determine what you have-as well as what you owe. However, neither report necessarily provides a clear picture of where cash is coming from, or going to. As shown in Figure 1, you’ll be able to see:

- How much cash you’ve taken in from sales and spent on expenses

- Cash inflows or outflows from borrowing, repayment, or investing activities

In short, this report shows you exactly what caused your bank balance to increase or decrease during a given report period.

Figure 1: The Statement of Cash Flows report explains changes in your bank account balance.

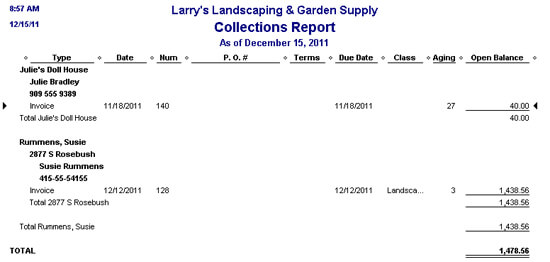

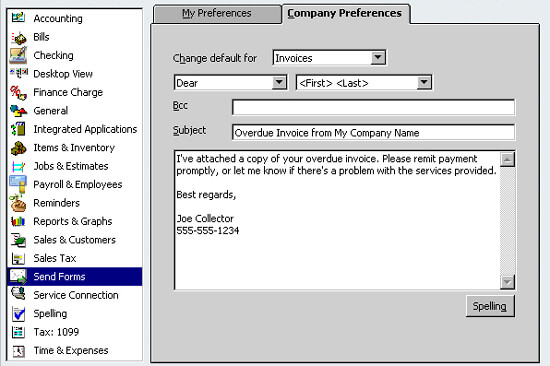

4. Collections Report: Tricky economic times mean it is more important than ever to keep track of your collections. Fortunately QuickBooks makes it easy to contact customers with overdue invoices: choose Reports, Customers & Receivables, and then Collections Report. As shown in Figure 2, the report provides a phone list and shows all overdue invoices. However, you can also use this report to quickly e-mail copies of overdue invoices to your customers. To do so, double-click on a transaction within the Collections report to view the invoice, and then click the Send button at the top of the invoice form to display the Send Invoice form shown in Figure 3. You can modify the wording shown to be more direct, such as a subject line of “Overdue Invoice” or perhaps e-mail text along the lines of “I’ve attached a copy of your overdue invoice. If there’s a problem with our products or services, please let me know immediately, otherwise I trust that you’ll remit payment promptly.” To change the default e-mail text, choose Edit, Preferences, and then choose Send Forms. Select Invoice from the Change Default For list, make your changes, and then click OK.

Figure 2: The Collections Report gives you a jump start on dunning overdue customers.

Figure 3: You can adjust the wording of an overdue invoice e-mail for one customer at a time or change the default text.

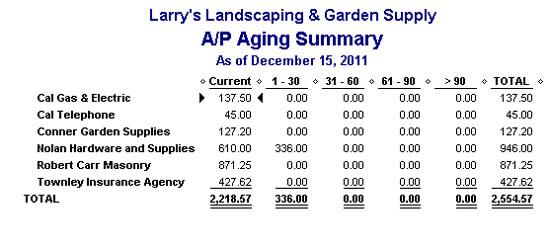

5. A/P Aging Summary: Although it’s key to make sure that your customers are paying in a timely fashion, it’s just as important to pay your vendors, too. Unpaid bills can result in phone calls, e-mails, and other unnecessary interruptions. Choose Reports, Vendors & Payables, and then A/P Aging Summary to display the report shown in Figure 4. As with most reports in QuickBooks, you double-click on amounts to ultimately drill down to the original transaction.

Figure 4: The A/P Aging Summary helps you determine when bills are slipping into overdue status.

6. Trial Balance: Many business owners overlook the Trial Balance report, since it’s one of the few reports in QuickBooks that uses the terms Debit and Credit. However, it’s a helpful report, as it shows you all account balances in a concise format. If anything looks out of order, simply double-click on the amount to view the underlying detail. Choose Reports, Accountant & Taxes, and then Trial Balance to view this report.

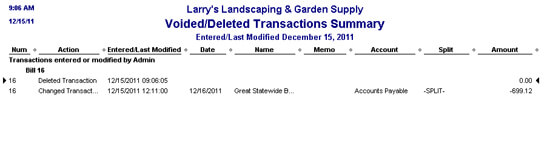

7. Voided/Deleted Transactions Summary: It’s no surprise that small businesses are much more prone to fraud than large businesses. Small business employees usually wear multiple hats, so it’s often impossible to separate financial duties (bigger businesses can do this with ease). Fortunately QuickBooks makes it hard for perpetrators to cover their tracks: choose Reports, Accountant & Taxes, and then Voided/Deleted Transactions Summary. As shown in Figure 5, you’ll be able quickly identify any transactions that have been deleted from QuickBooks. Granted, this isn’t an end-all solution by any means, but it is a helpful management tool. Plus, if a transaction ends up “vanishing” from QuickBooks, you can use this report to see who deleted it!

Figure 5: The Voided/Deleted Transactions Summary enables you to find transactions that appear to have vanished.

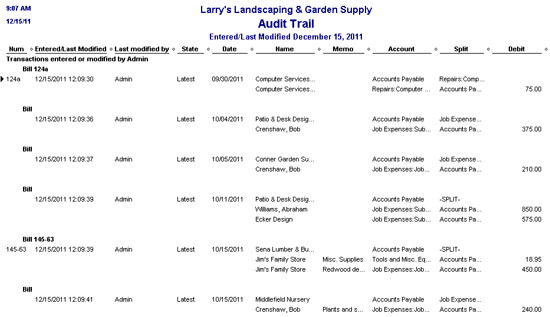

8. Audit Trail: The audit trail was an optional feature in earlier versions of QuickBooks, but is permanently enabled in recent versions of QuickBooks. This provides a complete record of every entry made in QuickBooks, as shown in Figure 6. The downside to that is that you can end up with a massive report. Don’t worry, as it’s easy to filter this report and narrow your search. To do so, choose Reports, Accountant & Taxes, and then Audit Trail. Once the report appears, click the Modify button, and then click on the Filters tab. You can filter by date range, amount, or dozens more fields.

Figure 6: The audit trail shows every transaction-including modifications-in QuickBooks.

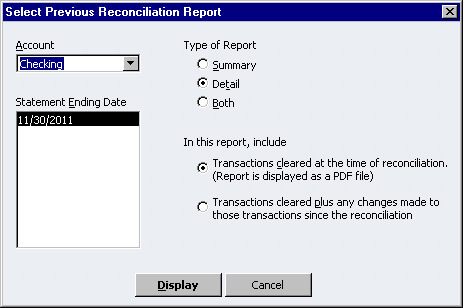

9. Previous Reconciliation: It’s a good practice to always print at least the summary report once you’ve reconciled a bank or credit card account. Someone else could edit a reconciled transaction, which could cause the reconciliation to be out of balance. A printed copy of the report shows that the account reconciled as of the report date, although you will still have to untangle the edited transaction. However, if you close out the reconciliation screen, you have a second chance to print your report: choose Reports, Banking, and then Previous Reconciliation. As shown in Figure 7, you can choose from multiple reports.

Figure 7: The Previous Reconciliation report option allows you to reprint missing account reconciliation reports.

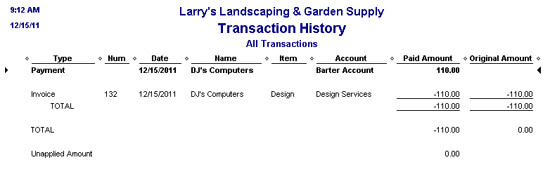

10. Transaction History: Think of this as a “report within a report”, as you can only run it in certain circumstances. As shown in Figure 6, you must have a transaction open on the screen or single-click on a transaction within a report. You can then choose Reports, and then Transaction History. As shown in Figure 8, QuickBooks will display a report that shows the entire history for a given transaction.

Figure 8: The Transaction History report provides shows all activity related to a given transaction.

Did You Know?

The Microsoft web site offers hundreds of free spreadsheet and word processing templates. Options range from timesheets to analysis tools to contract documents. Visit http://office.microsoft.com/templates, and then search for a template by use (home, office, school), collection (real estate, small business, wedding), or keyword. Indeed, if you’ve created a template that you rely on, you can submit it to the site and share your work with others!