Using Statements in QuickBooks: The Basics

Sending invoices to your customers to bill for products and/or services is probably one of the more enjoyable parts of your job–second only to recording payments received. And thanks to the company file you’ve built in QuickBooks, creating invoices is generally a very simple process that requires no duplicate data entry.

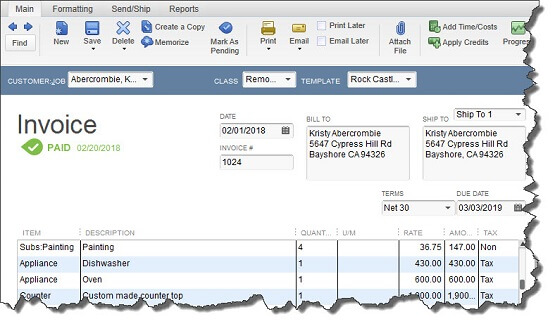

Figure 1: You probably use QuickBooks’ invoice forms frequently, so you know how much easier it is to fill them out than to create paper bills.

QuickBooks also includes easy-to-use templates for another kind of customer form: the statement. These forms are generally not used nearly as frequently as invoices. However, you may find them more appropriate if you:

- Want to create a form that lists all of a customer’s open charges

- Have a customer who accrues multiple charges before being billed

- Receive advance–or regular–payments, or

- Need a historical accounting of a customer’s activity, including charges, payments, and balance.

Limitations of Statements

QuickBooks places some restrictions on statements. For example if you have a number of related charges for which you want to create a subtotal for, you’ll have to use an invoice. Statements also cannot include sales tax, percentage discounts, or payment items. Products or services requiring descriptions that run more than a paragraph can’t go on a statement. Customization options, too, are limited: you can’t add custom fields to the statement form, nor can you include a message to your customers, like, “We appreciate your business.”

The “Reminder Statement”

There may be occasions when you want to create a form that lists invoices received, payments made, and any credits given for one or more customers. This may be necessary when, for example, a customer disputes a charge. You may also want to send out these statements to remind customers of delinquent payments.

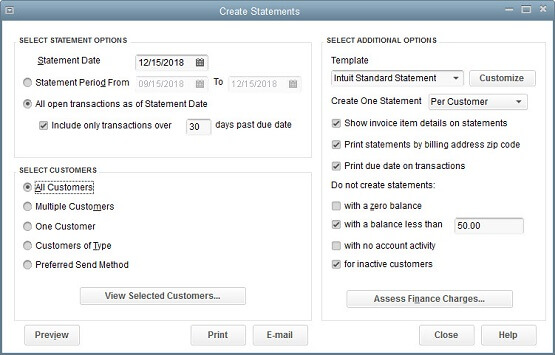

You do not have to enter any new data for these statements. Instead QuickBooks will pull the existing activity that you ask for in the Create Statements window, shown below. To get there, either click on the Statements icon on the home page, or open the Customers menu and select Create Statements.

Figure 2: The Create Statements window in QuickBooks offers multiple options for defining the statements you want to send to customers.

As you can see, QuickBooks offers a lot of flexibility in the creation of statements. You can specify:

- The active date range. Under SELECT STATEMENT OPTIONS, you can either enter a date range or request a statement for every customer who has open transactions as of the Statement Date (be sure that this date is correct before proceeding). You can also ask to include only transactions that are past due by a specified number of days.

- The customers to include. Do you want to use the conditions you just outlined to apply to All Customers? If so, click on the button in front of that options. If you choose Multiple Customers, a small button labeled Choose… will appear. Click on it, and a window displaying your customer list opens. One Customer also opens your list of customers. If you’ve assigned types to your customers and want to include only those in one category (like Residential or Commercial), click Customers of Type. And Preferred Send Method lets you limit your statement output to customers who receive either emailed or printed forms.

- The template to use. Click the down arrow to see the statement templates available. If you have not customized QuickBooks’ standard form and want to do so, let us help.

- Whether QuickBooks prepares one statement per customer or per job. This is a very important distinction, so choose carefully.

- Miscellaneous attributes of your statement run. Click on the box in front of any that should apply.

If you assess finance charges, you can do so here. This is an advanced activity in QuickBooks, and we’d be happy to provide guidance in this area.

When you’re done, you can Preview your statements, Print, or E-Mail them by clicking those buttons.

Entering Individual Charges

If you need to enter individual charges, you’ll have to work with QuickBooks’ customer registers. You’ll find these by either opening the Customers menu and selecting Enter Statement Charges or highlighting a customer in the Customer Center, then clicking the down arrow next to New Transactions and selecting Statement Charges.

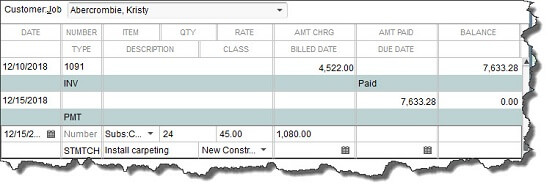

Figure 3: A Statement Charge in the customer register.

We highly recommend that you let us help you get started if individual charges are necessary. Like many of QuickBooks’ functions, this isn’t a difficult activity once you understand it. But it’s much easier and economical for you to get upfront guidance than for us to come in and untangle your company file.