Why QuickBooks Should Be on Your Desktop

If you’re still doing your accounting manually you are at a competitive disadvantage–even if you’re a very small business. You might be managing just fine using Microsoft Word for invoices and records and Excel for reports, but keep in mind that many of your rivals manage their financial data digitally.

Some of your competitors likely use QuickBooks; it’s the market leader, and it’s on millions of desktops. While you might feel that the products and/or services they use are not necessarily superior to what you are using, they have an edge because managing their financially data digitally enables them to run their businesses more efficiently. Furthermore, when you use software like QuickBooks your customers perceive you as someone who is technology-savvyâ??and it could help you build better customer relationships. Just maybe it’s time to update your accounting system too. Here’s what your competition has learned about managing their financial data digitally and what you, too, can experience when you use QuickBooks.

How It Helps

First, there is never a good time to make the transition to new software. Switching to QuickBooks is going to cut into your productive hours, and it will take time to learn how it works before you can start using it daily. But don’t worry. A QuickBooks professional can accelerate that process by helping you implementing it and training you on its operations. Once you get going, you’ll discover a whole range of benefits that you may not have even considered, such as:

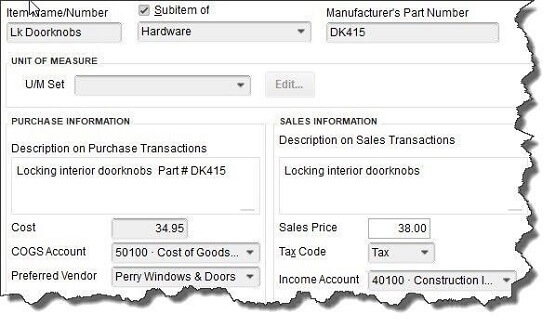

Figure 1: Once you’ve created an item record, for example, QuickBooks stores it for use in transactions.

Minimized errors. Once you’ve entered data into QuickBooks, whether it’s a customer’s address or the price and description of a product or service, the software stores it. It will appear in lists that you can access when, for example, you’re creating invoices. Not only does this improve accuracy, but it also makes duplicate data entry unnecessary.

Faster payments from customers. QuickBooks supports merchant accounts. Sign up for one, and you’ll be able to accept direct bank transfers and credit/debit cards from customers. You can automatically include a payment stub on invoices to speed up the remittance process.

Real-time account balances. Supply your login information for your online banks and other financial institutions, and QuickBooks can connect to them. It imports cleared transaction data regularly and helps you reconcile your accounts. You can even set it up to pay your bills electronically.

Instant data access. Do you have a customer on the phone with a problem concerning an invoice or payment? QuickBooks’ search tools help you track down the smallest detail in seconds.

Time-tracking. If you (or your employees) provide services that are billed back to customers, you can create time records individually or on a timesheet. These blocks of hours and minutes can be marked billable, so they’ll appear the next time you start an invoice for any affected customers.

Figure 2: If your company sells services, you can create individual time records or comprehensive timesheets and mark sessions as billable.

Improved customer relationships. Your customers want answers when they have problems or questions, and they want them quickly and accurately. QuickBooks lets you store all needed details about customers in records, including contact information, payment particulars, and transaction history. Nothing helps encourage future sales like a company that knows its customers.

A more contemporary image. Those invoices and statements you create in Word–or worse, write by hand–contribute to your customers’ impressions of you and your commitment to using state-of-the-art technology to better serve their needs. When you email professional-looking, carefully-customized sales and purchase forms, you’re likely to go up a notch in their eyes.

Feature flexibility. You can use a little of QuickBooks and still have it be worth your time and technology dollars, or you can stretch its capabilities to the limits. If the latter happens, you may want to expand the softwareâ??s reach by integrating it with one of the hundreds of add-ons available in areas like inventory, invoicing and billing, and CRM.

Time and money savings. Believe it or not, this is actually the most compelling reason to use QuickBooks. Yes, you have to pay upfront for the software and it takes time to get used to using it, but you’ll soon see that your investment will reduce the hours you spend on accounting. And that means you’ll have more time to do what only you can do: make your business flourish by planning for its future and taking the actions that will move you toward greater success.

Need Help?

Have you installed QuickBooks but are having trouble using its features fully? Do you need some guidance, particularly in the area of advanced reports? Don’t hesitate to contact the office and let a QuickBooks expert assess where you are with the software and devise a plan to complete its implementation. You may be surprised to learn what you can do.